Isle of Man Post Office Celebrates 60th Anniversary of Peel Engineering

22nd July 2024

Isle of Man Post Office is delighted to announce the release of a sheetlet commemorating the rich and fascinating history of Peel Engineering.

From 1st January 2021, all postal administrations dispatching goods will have to supply recipient postal administrations with electronic customs data detailing the contents of any mail and parcels containing goods. This concerns all items containing goods to be sent to destinations beyond the UK including the Channel Islands.

From Friday 1st January 2021, the requirement for accurate customs documentation for items containing goods sent to Rest of World addresses will also apply to EU destinations. The changes are required by the Universal Postal Union (UPU) and the World Customs Organisation (WCO).

It has always been a requirement for customs declaration forms (CN22A/B and CN23 for mail and CP72 for parcels sent via Parcelforce) to be used for countries beyond Europe, but from 1st January 2021 they will need to be used for all destinations beyond the UK including the Channel Islands – Jersey, Guernsey, Alderney, Herm and Sark.

The information provided on the customs declaration forms (set out below) will be captured and forwarded digitally to the destination postal administration and their Customs Officials, in advance of the goods being despatched. This method of providing customs data will help to automate and speed up manual processes, which can enable a more efficient customs clearance process as well as supporting an effective risk-based customs control.

Which form do I need?

'Old' versions of the CN22 and CN23 will no longer be accepted, only the forms outlined in the table below will be accepted.

| Form | Image | When to use |

| CN22A | .jpg) |

Please use this form if you are sending goods valued at less than £270 and using any of the following services:

|

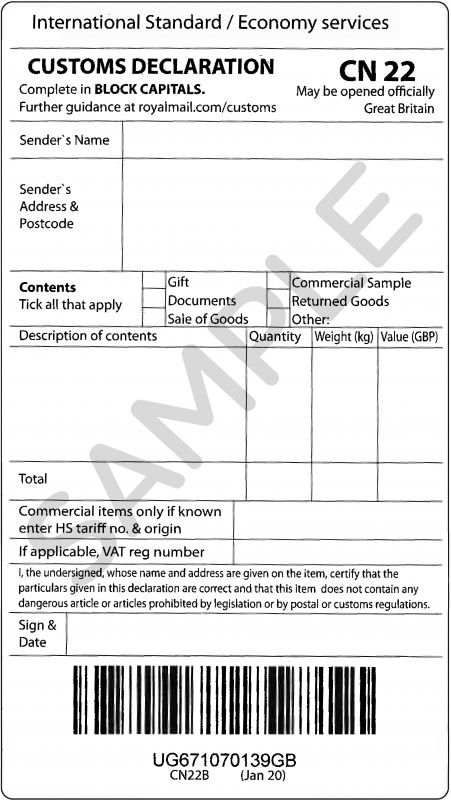

| CN22B |  |

Please use this form if you are sending goods valued at less than £270 using standard non-tracked services for destinations beyond the UK including the Channel Islands. |

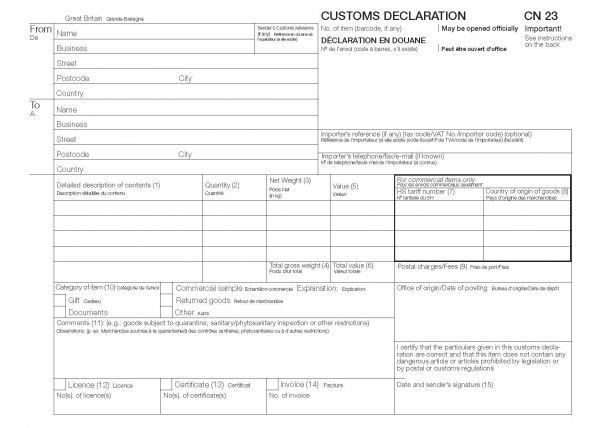

| CN23 |  |

Please use this form if you are sending goods valued at £270 or more using any service for destinations beyond the UK including the Channel Islands. |

CP72s are used when sending parcels using Parcelforce services.

How to obtain customs declaration forms?

Forms are available from all Post Offices, or to download at the bottom of the page. If you are a commercial organisation or sending large volumes you can order direct from our stores on stores@iompost.com. When ordering from stores you must stipulate:

Information required for customs declaration forms

To complete the customs forms accurately the following information is required for each item (containing goods):

Goods which are damaged will not be accepted, so please ensure you package your items well. For hints and tips on packing your items, click here.

For commercial items only:

For more information about how to complete the customs declarations please view our CN22 Explained documents which are available to download at the bottom of the page.

From 1st January 2021 any items received by Isle of Man Post Office without the above information may be delayed or returned and subject to further charges.

This page will be updated frequently, so please do check back regularly. In the meantime please see below some Frequently Asked Questions to provide further context to these changes.

Frequently Asked Questions

What is Electronic Customs Data (ECD)?

Electronic Customs Data is the electronic transmission of customs information. The contents data needs to be captured electronically and transmitted to the country of destination. This is due to statutory and international requirements. The new requirements are internationally valid and are coordinated by the Universal Postal Union (UPU) in cooperation with the World Customs Organisation (WCO).

Why do customers need to provide ECD?

ECD is required to ensure that existing, emerging and future legislative, security and customs requirements in overseas destinations are met. Some countries are applying penalties, delaying or returning items in the absence of the required data and we want to help our customers avoid this. If customers ensure all the correct data is provided when the item is posted, this data will be collected and forwarded by IOMPO.

What are the benefits of ECD?

Providing complete and accurate electronic customs data will:

Which countries require customs declarations?

All destinations outside of the UK, including the Channel Islands – Jersey, Guernsey, Alderney, Herm and Sark require customs declarations.

What items are considered as documents?

His Majesty’s Revenue and Customs’ (HMRC) definition is that letters, postcards, braille letters, individual invoices / statements don’t need CN22s, but magazines, periodicals, bulk sets of blank forms (such as invoices and statements) all need customs declarations as these are goods and should have a value applied under valuation methods as usual.